Credit Bureau Services

For The Rental Industry

Credit Bureau Reporting Benefits Everyone

Credit Bureau reporting helps Housing Providers make informed decisions. It enhances accountability, encouraging timely rent payments and responsible behavior. Renters can build a positive rental history, improving their chances of securing future housing.

Tools to Improve Renting for Everyone

Unlock the Benefits of Credit Bureau Reporting

Rent Reporting

Services

When rent payments are reported to Credit Bureaus both Housing Providers and Renters benefit.

Credit Building

Services

Improved credit can help Renters stand out when applying for new housing and secure their preferred home.

Tenant Screening

Services

Thorough Tenant screening helps Landlords find reliable Renters and maintain a safe, well-managed property.

Debt Reporting

Services

Remove the stress of unpaid rent. Credit Bureau collections can help you recover debts from former Tenants.

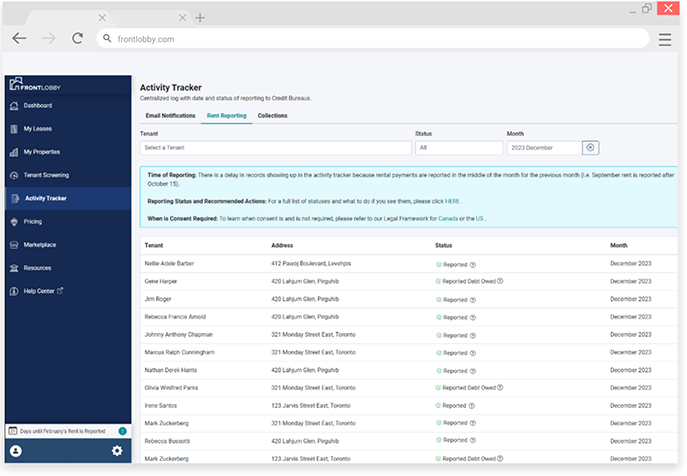

How to Report Rent

Payments?

To report rent to Credit Bureaus, Housing Providers need to sign up for rent reporting service like FrontLobby.

Rent Can Count

Towards Credit

Until the development of Rent Reporting, Tenants were unable to build credit through their monthly rent payments.

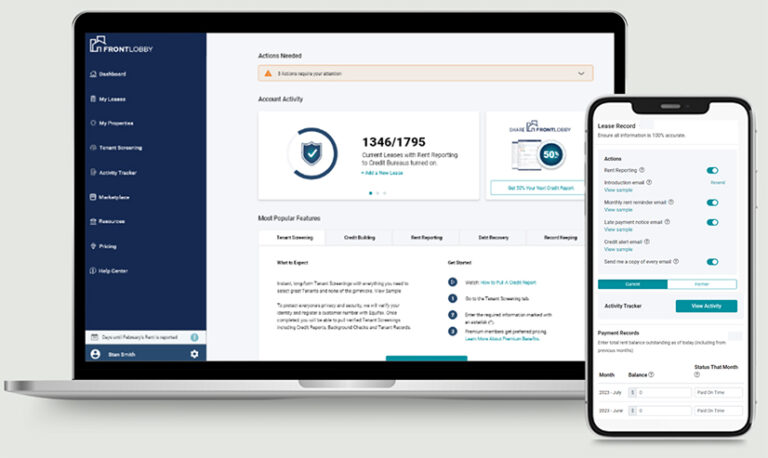

Rent Reporting Services

How It Works

1

Sign up to FrontLobby as a Renter or a Housing Provider and enter the lease details.

2

Monthly rental payments are tracked and shared with the Credit Bureaus.

Credit Building Services

Tenants can report rent payments to Credit Bureaus as a way to build credit, which is essential for securing homes and obtaining better loan terms. Housing Providers who offer credit-building services can in return attract high-quality Renters.

How It Works

1

Tenants sign up and enter their lease details using FrontLobby.

2

Rent is paid and shared with the Credit Bureaus each month.

3

Every on-time payment builds credit history and could improve credit score.

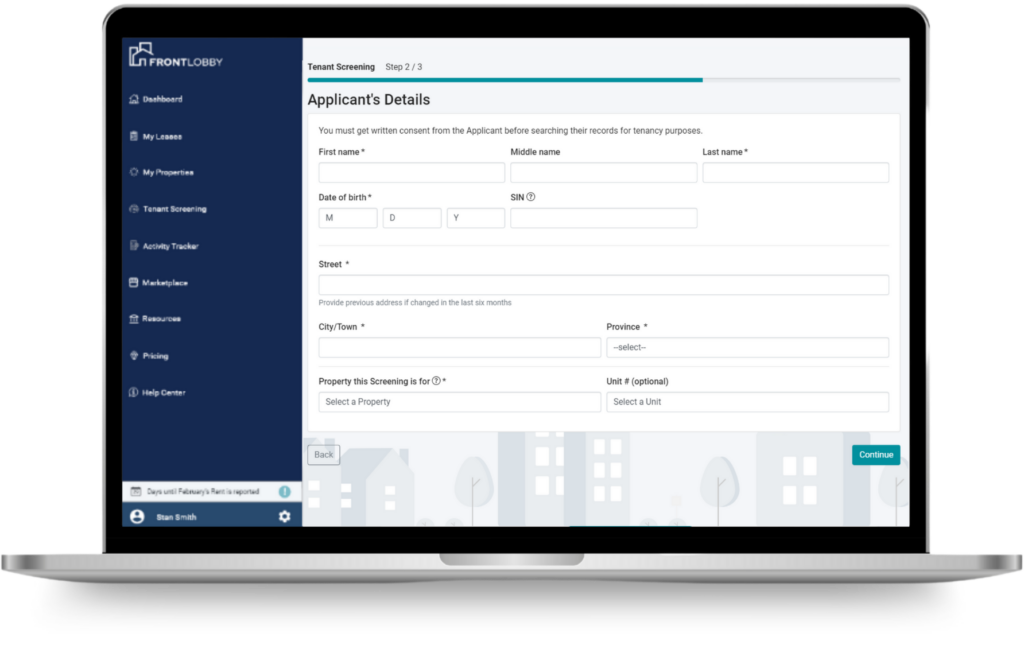

Tenant Screening Services

FrontLobby’s US Tenant Screening services allow Housing Providers to pull credit reports on potential Tenants. By reviewing a Tenant’s financial history and rental record, Landlords can make informed decisions about whom to rent to.

How It Works

1

Sign up at FrontLobby and choose your Tenant Screening package.

2

Select the most reliable and responsible applicant for their rental unit.

Debt Reporting Services

Reporting debts to Credit Bureaus can help Housing Providers recover unpaid rent by

holding Tenants accountable for their financial obligations. This practice not only aids in

debt recovery but also promotes responsible Tenant behavior.

How It Works

1

When a rent payment is missed it may be shared with Credit Bureaus.

2

Tenants are incentivized to communicate and settle the outstanding debt.